Funding Your Retirement - Balance Approach

By: Kelly Hutchinson | Category: Financial Services | Issue: February 2020

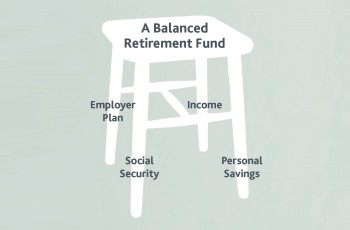

Imagine your retirement fund as the seat of a stool.

Its stability depends on the construction of the legs. Put all the weight on one leg of the stool and you risk a wobbly future. Instead, use multiple funding sources to build a sturdier retirement savings plan.

Depending on your desired lifestyle, we suggest saving between 10-20% of your salary to fund your retirement. Use this balanced approach to diversify savings.

1st Leg - Employer Plan

If your employer retirement plan offers a match, fund this account up to the full match if not more. If your employer does not offer a match, you will want to contribute more money toward this account.

2nd Leg - Social Security

Social Security benefits can vary drastically depending on how long you work, the amount you earn during your highest-earning years and when you elect to claim your benefits. The generation retiring now is receiving about 35-40% of their former salary in the form of Social Security benefits.

3rd Leg - Personal Savings

This may include savings accounts, IRAs, CDs, investment accounts and your home’s equity.

While it is possible to build a solid three-legged stool, you may want to reinforce your retirement fund with a fourth leg.

4th Leg - Retirement Income

Income may be in the form of a rental property, part-time job or small home-based business.

However you go about it, you have to sit on your retirement stool, so make it sturdy enough to hold you during your retirement years.

Find a wealth advisor you trust to help you plan a retirement savings strategy built for your individual lifestyle goals and needs.

RCB Bank Financially Fit

For more information, contact:

More about RCB Bank Financially Fit:

More ArticlesSubscribe

For Free!