The Number One Reason Why You Need to Use Text Banking

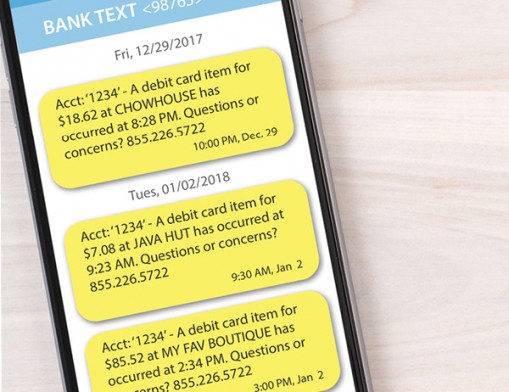

Make text banking your first defense against fraud.

By: Kyle Head | Category: Financial Services | Issue: January 2018

Fraud can happen to anyone. It happened to me and text banking tried to warn me.

I was out of town. I noticed two purchase alerts in my messages. My wife and I share an account and she had recently been to a craft fair, so I assumed they were hers. I was in a hurry and did not verify the transactions. My mistake. A couple of hours later, my bank called to inform us these were fraudulent charges on my wife’s card. Luckily, they caught it quickly and canceled her card before other fraud occurred.

Fraud departments are great at what they do, but so are fraudsters. It’s ultimately up to me to keep track of what is happening on my account. Text banking allows me to monitor account activity quickly and easily throughout the day from my phone. If I don’t recognize an expense, I can check it out right then. Detecting fraud early can help minimize loss.

Many major credit card companies also offer text alerts. Let text banking help you guard your money.

You can use text banking to check account balances, transfer money between accounts and notify you when your balance falls below a specific dollar amount. You can pick and choose which alerts you want to receive. Smartphone and Wi-Fi not required.

Learn more ways to protect your money at RCBbank.com/GetFit.

Opinions expressed above are the personal opinions of the author and meant for generic illustration purposes only. Message, data rates and fees may apply.

RCB Bank Financially Fit

For more information, contact:

More about RCB Bank Financially Fit:

More ArticlesSubscribe

For Free!